The Rising Cost of Home Insurance: How Real Estate and Mortgage Companies Can Help Buyers Navigate the Market

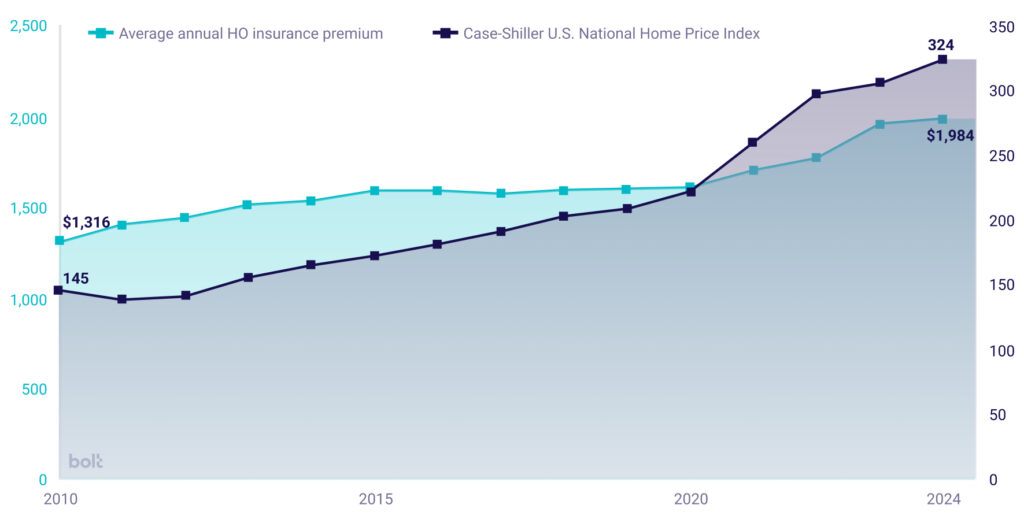

Skyrocketing insurance costs are more than just a press scare story. Home insurance cost trends are heading up, and both buyers and renters face premium increases and coverage limitations, or even policy cancellations. Needless to say, this creates significant friction in both insurance costs and availability, leaving clients frustrated and deals in jeopardy.

Forward-thinking real estate professionals to the rescue. By using embedded insurance in real estate, you can not only solve a growing pain point but even create additional value. Implemented well, you will also see new revenue streams while enhancing existing client relationships.

If you’re curious about how real estate agents can offer home insurance or help prevent insurance-related delays in home closings, insurance integration is key. It’s a powerful tool that every realtor should understand.

The Perfect Storm of Challenges for Insurance

We’re in an era where every year seems to bring more extreme climate events. In 2024 alone, there were 27 confirmed weather and climate-related events where losses topped $1 billion each.

With these comes a dramatic increase in claims frequency and severity. Insurers are paying out record amounts for wildfire, hurricane, and flood damage. Last year, global insured losses alone were more than double the 30-year average of $60 billion, closing at $140 billion.

That’s not all that’s driving home insurance cost trends upwards, either. Inflation has driven up construction costs, increasing the price of home repairs and replacement builds. Supply chain disruptions have eased in the post-pandemic period, but continue to impact claim resolution timelines.

Homeowners insurance rates in the US have risen on average by 8.7% annually since 2018, far outpacing inflation. This is particularly dire in high-risk states like California and Florida – if they can find coverage at all.

Many major carriers have significantly reduced their exposure, or completely withdrawn from high-risk markets, leaving numerous property owners adrift. Thousands of Los Angelinos were dropped by their insurance before the Palisades wildfires tore through the state, and they’re far from alone.

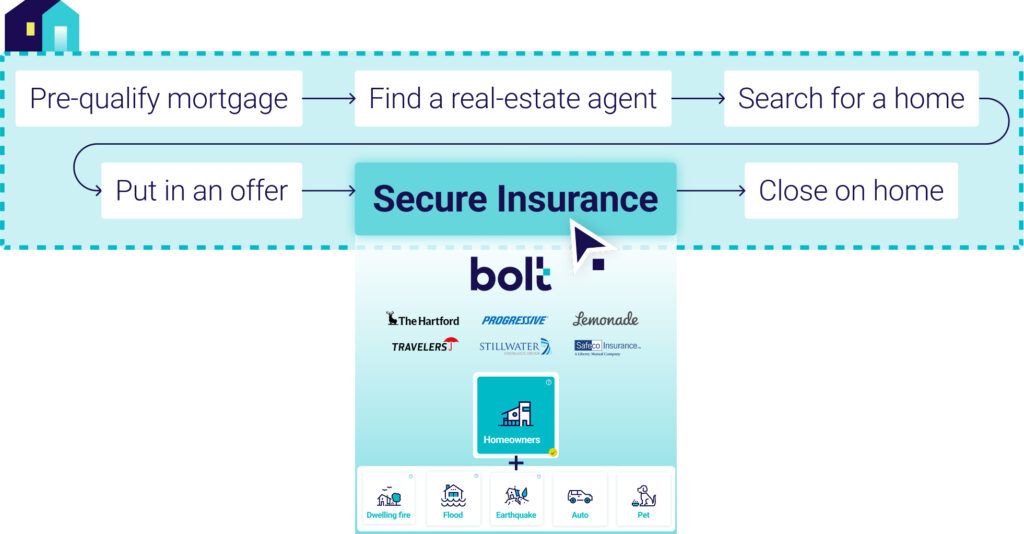

For real estate professionals, these challenges mean last-minute complications that threaten transactions. Mortgage contingencies typically require insurance in real estate transactions, while renters are finding new lease agreements that demand liability protection. If these policies cost more than is budgeted for (or worse, coverage isn’t even available), we see closings stall and lease signings collapse. With it comes plummeting client satisfaction and increased pressures on brokers.

The traditional approach of letting clients figure out insurance on their own isn’t working anymore. Luckily, embedded insurance in real estate offers a new way forward that works better for all parties.

Strategies for Solving Delays in Home Closings and Real Estate Insurance

To solve these looming issues in home insurance cost trends, there are two key strategies to try.

Make Insurance a Seamless Part of the Client Experience

If you’re striving for innovation and looking to make better use of real estate digital tools, now is the time. Embedded insurance makes protection part of the client journey, not just an afterthought. It offers home buyers and renters insurance options during critical parts of the sales or leasing process. Think of mortgage origination, home sales, or tenant onboarding.

This turns the roadblock into a valuable new service – and can also be used as a new revenue stream. It can even be introduced at pre-qualification. The embedded insurance market is in a boom at the moment, so first movers will net a considerable advantage as well.

As a property management insurance solution, embedded insurance’s key is simplicity. Clients no longer have to navigate complex insurance marketplaces independently. Instead, you offer them access to multiple quotes through a streamlined, integrated experience. This reduces friction with the client while positioning your business as a complete solutions provider. Real estate digital tools now make it easier than ever before to offer embedded insurance.

Restore Trust and Confidence in a Volatile Market

Between record-high insurance premiums, carrier pullbacks, and limited housing inventory, buyers and renters face mounting uncertainty during an already stressful process. In a market where rising rates and low supply are shrinking options, agents have a critical opportunity: to offer more of the complete home-buying experience by embedding insurance directly into their services.

Embedded insurance restores client confidence by providing instant access to a broad network of carriers—including regional and specialty insurers clients may not find on their own. This is especially valuable in catastrophe-prone areas where traditional coverage options have disappeared.

By offering multiple options tailored to the property’s location and characteristics, you empower your customers to make informed decisions and secure the coverage they need—without slowing down the transaction. It’s a modern, digital-first solution that transforms insurance from a roadblock into a moment of added value.

How bolt Empowers Real Estate Professionals

If you’re ready to offer your customers the real estate digital tools they need to thrive despite a tough insurance market but aren’t sure how to start, think bolt.

Our unique cloud-based, single API platform is helping bring insurance into real estate the right way. Whether you’re looking to integrate it into your existing processes or establish something like a standalone renter’s insurance platform, bolt’s unique model offers:

- Real-time quoting and binding across multiple insurance carriers for both homeowners and renters coverage

- Easy integration through APIs that connect seamlessly with existing platforms and workflows

- Data-driven personalization that matches clients with appropriate coverage options

- Streamlined digital experiences that eliminate paperwork and accelerate approvals

Offering tools like a renters insurance platform, or embedded insurance that’s part of the home buying cycle, lets you bring carriers and options directly to your client, at the time they most need it. It also lets you make the most of new revenue streams, delivering monetization opportunities through insurance commissions with minimal operational lift.

If you’re looking for a streamlined, simple-to-deploy property management insurance solution, bolt is ready to work for you.

Actionable Takeaways for Real Estate Professionals

Solving insurance delays in home closings needs a focused approach to overcoming the challenges we’ve discussed. Real estate professionals and companies exploring renters insurance integration can take the following steps to not only simplify, but enhance, their customers’ experiences:

- Integrate insurance early in your process: Don’t wait until the final stages of a transaction to consider coverage needs. By introducing insurance during initial client consultations and as an integrated part of the rental or purchase cycle, you prevent last-minute surprises and position yourself as a comprehensive, trustworthy advisor.

- Leverage technology to simplify insurance procurement: Modern real estate digital tools with embedded insurance capabilities, like bolt, can transform a complex, time-consuming process into an efficient experience for both customers and staff. It also positions you as a future-forward and caring company.

- Create new revenue opportunities: Most embedded insurance solutions include commission structures that allow real estate businesses to generate incremental revenue while solving a critical client need.

- Differentiate your business in a competitive market: As insurance challenges continue to mount, being able to offer integrated solutions gives you a competitive advantage that can help to attract and retain clients.

The market and home insurance cost trends may be hard to navigate, but there’s no reason your customer journey should be. With the right partner to help you offer simple embedded insurance solutions, you can empower your customers and your business in one integrated offering.

Insurance in Real Estate: Looking Forward

Insurance is no longer optional for real estate customers and businesses alike. It’s essential for building a positive customer experience. Real estate professionals can lead the pack by offering the right embedded insurance solutions, driving loyalty and revenue alike.

Partnering with bolt positions your business for long-term market resilience as well as client satisfaction – and that’s a difference every real estate business needs. If you’re ready to make insurance one less obstacle for your customers, learn how to integrate embedded insurance solutions with bolt. Contact us today.

Further Reading

Featured

18 June 2024

18 June 2024

15 August 2024

15 August 2024

1 July 2024

1 July 2024